.svg)

Prop Firm Risk Rules 101: The Must-Have Trading Rules and How to Enforce Them

Prop Firm Risk Rules 101: The Must-Have Trading Rules and How to Enforce Them

Prop trading firms live and die by their risk rules. In an industry where traders leverage firm capital, robust trading rules are the only thing standing between orderly operations and potential disaster. This introduction to prop firm risk management covers the must-have trading rules (like daily loss limits, drawdowns, and max lot sizes) and how to enforce them effectively in real time.

Must-Have Risk Rules in Prop Trading

Modern prop firms enforce a core set of risk management rules to protect both the firm and the traders. These rules act as guardrails, ensuring no individual’s trades jeopardize the firm. Key rules include:

- Daily Loss Limit: A cap on how much a trader can lose in one day. For example, a firm might allow a 5% account drawdown in a single day – if exceeded, trading stops. This prevents one bad day from snowballing. Many prop firms impose strict daily loss limits to instill discipline. In practice, firms auto-liquidate accounts for the day once the limit is hit, halting further losses.

- Maximum Drawdown: A cap on cumulative losses from the account’s starting balance, often calculated as either a fixed or trailing percentage. If equity falls beyond this limit—commonly 10%—the account is closed. This rule protects the firm by limiting the impact of prolonged losing streaks and discouraging reckless risk-taking.

- Max Position Size (Max Lots): A ceiling on trade size or effective leverage to stop outsized bets. Firms typically tie the allowable lot size to account balance (e.g., up to 5 lots per $50k). This standardization limits exposure so a single trade can’t jeopardize the firm.

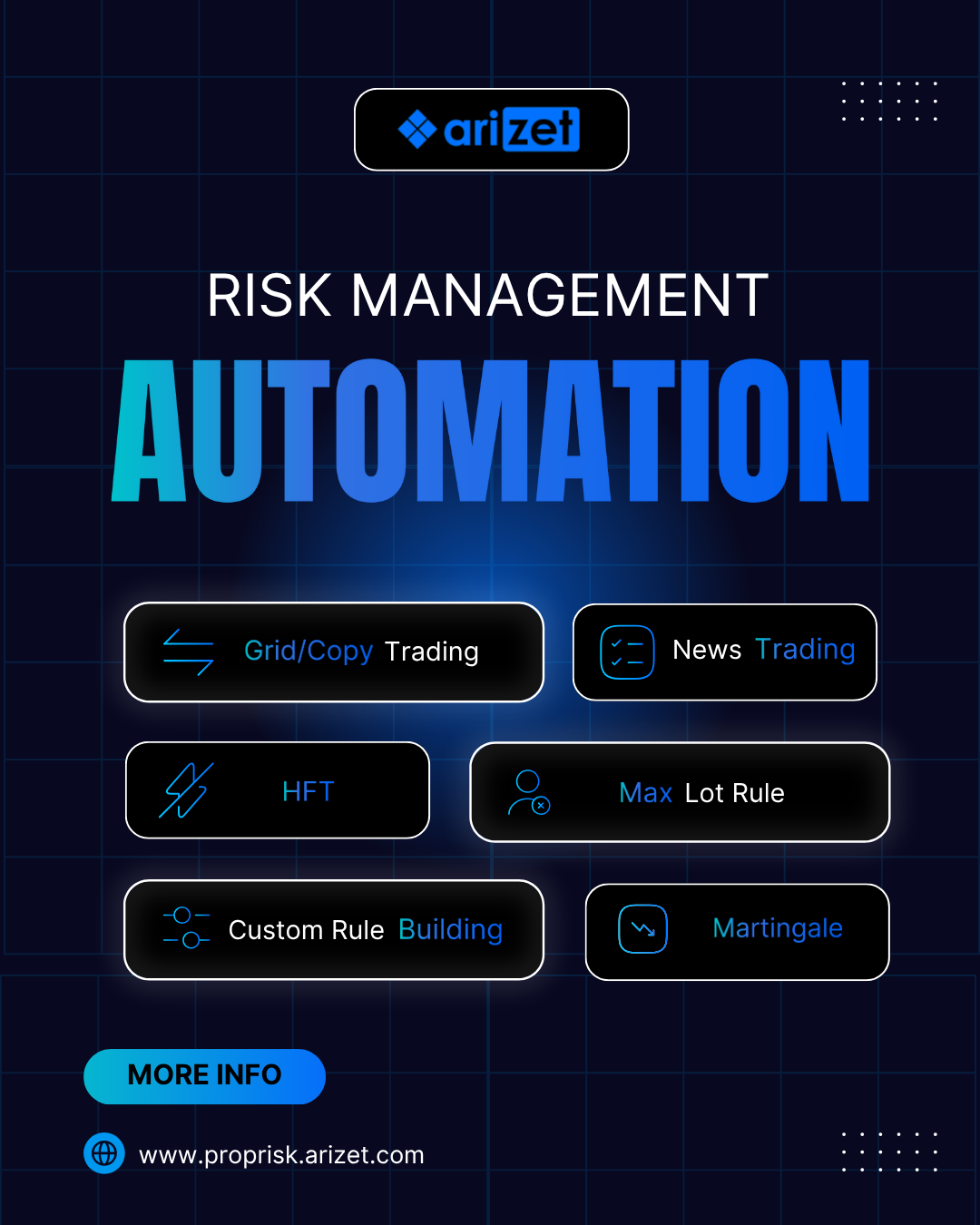

- Other Rules: Many firms add rules against specific high-risk behaviors. These can include no martingale strategies, no news trading during major releases, maximum accounts per trader, or consistency rules requiring steady performance. While these aren’t universal, any rule that curbs outsized risk is worth considering. The exact rule set can be tailored, but the goal is the same: prevent catastrophic losses.

These rules establish a culture of discipline from the outset. Traders know exactly where the boundaries lie, and crossing them—such as hitting the daily loss limit—results in immediate loss of account access, often with forfeited fees or profit share. The penalties, which can include account closure or loss of eligibility, provide strong motivation for traders to follow sound risk management practices. Ultimately, well-structured rules filter out reckless participants and safeguard the firm’s capital.

Enforcing Rules in Real Time (No Excuses)

Having rules on paper won’t protect a firm unless they are actively enforced. The timing and consistency of enforcement are where many firms fall short. Depending on manual log checks or end-of-day audits leaves too much room for breaches to go unnoticed, often until significant losses have already occurred. When oversight is delayed or inconsistent, the consequences can be severe—missed violations, unexpected payouts, and damage to the firm’s financial stability. The lesson? Delayed or lax enforcement can be fatal.

Manual monitoring is error-prone and costly. If risk managers are reviewing trade reports by hand, it’s easy to miss violations or react too slowly. A trader could breach a loss limit in the morning and continue trading all day if nobody notices. The “high cost of doing nothing” (i.e. not automating) includes: unobserved rule breaches, inconsistent application of rules, higher labor costs, and even reputational damage. As one CEO put it, “The risk is incredibly hard to manage in the prop trading industry” when firms assume traders will self-police, and currently many firms handle risk checks manually (Finance Magnates, Aug 8, 2024). In 2024, PipFarm’s CEO warned that manually-managed risk makes it tough to scale operations – it requires more staff and carries constant oversight burden. Human risk managers need sleep; automated systems don’t.

The solution is real-time, automated enforcement. Technology now enables prop firms to monitor trading activity tick-by-tick and enforce rules the instant they are violated. Arizet’s Prop Risk system is one such technology: it enforces all trading rules tick-by-tick… live and instantaneous, meaning the moment a rule is breached, the system acts. If a trader hits the daily loss, Prop Risk immediately flags and closes the account in coordination with the trading server. There’s no room for debate or delay. This kind of systematized enforcement ensures fairness and consistency – every trader, every rule, every time. By automating uniformly, firms avoid any perception of favoritism, and every trader knows that if they break a rule, the system will catch it. This not only deters would-be rule breakers but also gives honest traders confidence that the firm is stable and rules are transparent.

Real-time enforcement isn’t just about stopping losses; it’s about running a professional operation. Firms that invest in automated risk control gain a competitive edge.

Bottom line: Define clear risk rules and enforce them relentlessly. Daily loss limits, drawdowns, and position caps form the backbone of prop firm risk management. With modern platforms like Arizet PropRisk (or similar real-time engines), enforcement is no longer a manual headache but an automated standard operating procedure. The must-have rules, combined with real-time enforcement, protect the firm’s capital and create a level playing field for traders. In prop trading, a rule that’s enforced in real time is worth dozens of rules that are only checked “after the fact.” Risk management is only as strong as its weakest enforcement link – with automation, those links are stronger than ever.

.png)